Viral Facebook pages claiming to be SME Development Bank in Myanmar providing loans easily online are well intimated and challenge the real authentic page of the bank. Fact Crescendo Myanmar found that it turns out to be fraudulent financial pages using SME Development Bank’s name

The following screenshot was taken from a Facebook page that shared this kind of claim on May 9. Along with the following text, video of SME Development Bank CEO Dr. Zeya Nyunt answering the situation of his bank effort to lend to small and medium enterprises, received more than 3.8K views on Facebook. The same claim can be found here on Facebook.

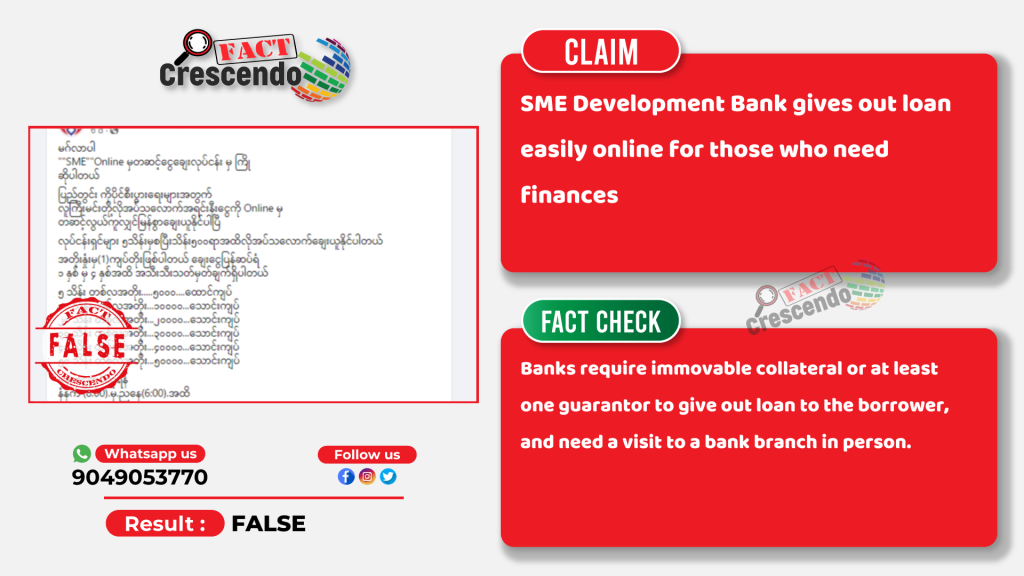

“Mingalarpar

Welcom from “”SME”” Online business loan

For locally owned businesses

Get as much cash as you need online

You can borrow quickly and easily

Entrepreneurs can borrow as much as they need from 500,000 to 50,000,000

The interest rate is just (1) kyat

Loan tenure from 1 to 4 years respectively

5 lakh monthly interest…..5000….Thousand kyats

10,000,000 monthly interest…10,000… Thousands kyats

20 lakh monthly interest… 20000… Thousands kyats

30,000,000 monthly interest…30,000… Thousands kyats

40,000,000 monthly interest…40,000… Thousands kyats

50,000,000 monthly interest…50,000… Thousand kyats

To take the loan cap

From morning (8:00) to evening (6:00

To check details online.. 24 hours service is provided, contact now”(Fair translation from Burmese)

Original link – Fb link | Archive link

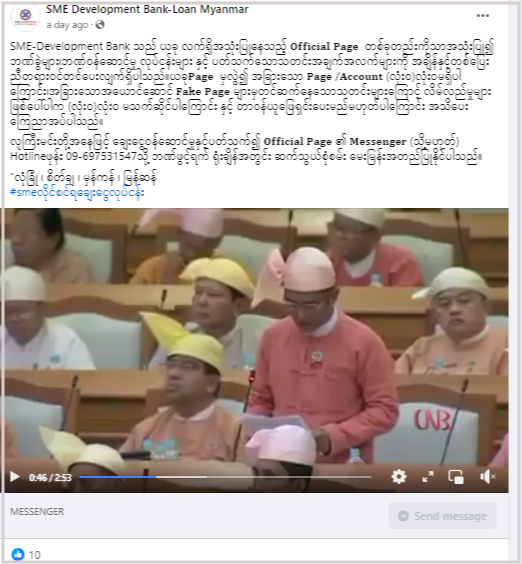

Another Facebook page named “SME Development Bank-Loan Myanmar” claims that the page is the only page representing the bank, also advertises that loans can be obtained online, and also shows a video of parliamentarians discussing the loan tenure in parliament. See here.

Does SME Development Bank really offer collateral-free online loans? Let’s see the facts.

Fact Check

In fact, it turns out that the advertised Facebook pages are the fake and scam pages using SME Development Bank’s brand and logo. Check out the official Facebook page of SME Development Bank here. The bank’s official page was launched on May 14, 2021, and has a total of 68,000 likes and 70,000 followers. When contacting the phone number listed on this page as a person who wants a loan, the bank answer is that in order to get a loan from a bank, it is necessary to have a business license issued by the Municipal Development Committee and tax records of business operation income, and to provide the bank with some type of collateral acceptable to the bank. The bank also lends employee loans, and for employee loans, the concerned company needs to submit proof of employee status and salary payment records.

The video in which CEO of SME Development Bank, Dr. Zeya Nyunt, is saying that his bank is giving out loans to businesses without taking collateral, depicted by a Facebook page named “SME BANK guaranteed loan business”, is in fact that this video is originally published in September, 2019, by BETV, a media organization based in Yangon, and he is speaking to a media at an event in September 2019. See the original publication here.

An official who asked not be mentioned, works as a branch manager at a private loan company, confirmed to Fact Crescendo Myanmar that the fact that loans are easily offered online is not often advertised by authentic loan operators, and for those who operate microfinance, they only issue loans after examining the income of the borrower. Loans are usually made only by guaranteeing each other in the form of a group base guarantee (a kind of guarantee in which if one people from the group failed to comply with repayment term, others have responsibility to pay back.

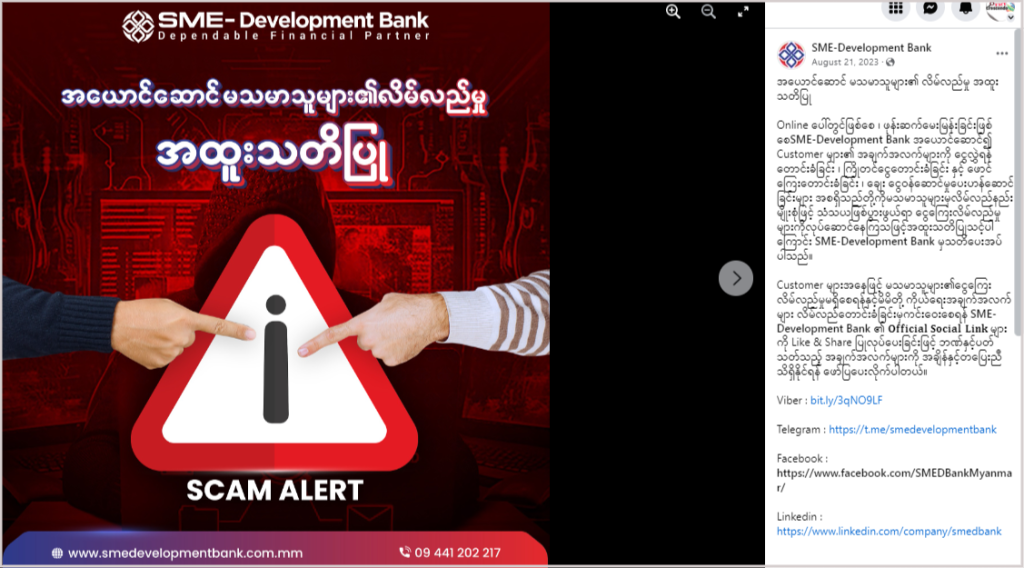

Impersonating its name, obtaining customer information, request advance payments and request form fees, SME Development Bank also warned in a Facebook post in 2023 that fraudsters pretending to provide loan services are conducting suspicious financial frauds in various fraudulent ways. (See this link)

A person in charge of the bank’s communications advisory role also contacted Fact Crescendo Myanmar and told that his client, SME Development Bank, was in trouble as financial fraudsters are targeting them.

Conclusion

Borrowers who want loans from banks normally would require visit to a branch office and apply in person to get a particular loan. And except for a few hundred thousand kyats that are usually loaned by microfinance companies, a business license, tax records, and operation income along with immovable collateral are required to get a loan form a bank. The fact that you can easily get a loan online in a few minutes is often a way that online scammers and financial fraudsters use to find victims.

Title:Fact Check: Does SME Development Bank give out loan easily online? – Just a scam

Written By: FC MyanmarResult: False